As a solopreneur, you might be considering how to separate yourself legally from your business or brand. By learning how to start an S-corp , your business can gain limited liability protection while potentially avoiding duplicate taxation, making it an appealing option for solopreneurs who seek all tax deductions and write-offs available to them.

An S-corp refers to a standard corporation that has sought "S corporation" tax status, allowing shareholders to report pass-through entity income on their personal tax returns.

Our guide will provide a comprehensive overview of the five steps required to successfully set up an S-corp, the advantages of this status, and how to know if an S-corp is right for your business type.

The first step in starting an S-corp is choosing your business structure type . You typically have two options when preparing your entity for S-corp status:

Choosing your business type carefully is crucial since this will become the foundation of your S corporation, once you elect S-corp status. After making your selection, you’ll have to register your entity with your local government.

Whether you choose to form an LLC or C-Corp, the next step in forming your corporation is to select an available business name to register it under. To find out if your business name is available, you can search on your local Secretary of State’s website. If your business name is anything but your actual name, you’ll also need to file a “ Doing Business As ” (DBA) name.

You will also need to determine which state you’ll incorporate your business in . Consider the following logistics while making your location decision:

You may need the help of a registered agent , someone who receives and shares legal communications for your company, to complete S-corp setup. They will generally correspond with the government on matters like your business taxes.

After you’ve successfully registered your corporation with your state, you’ll need to apply for an Employer Identification Number (EIN) with the IRS. An EIN is a unique nine-digit number the IRS assigns to domestic businesses for identification and tax reporting purposes. An EIN allows you to accomplish the following:

You get your EIN by preparing and submitting Form SS-4 to the IRS. It’s important to note that an EIN is also known as a Federal Tax ID Number and a Federal Employer ID Number. This number is free to obtain and is crucial to running a legally sound business.

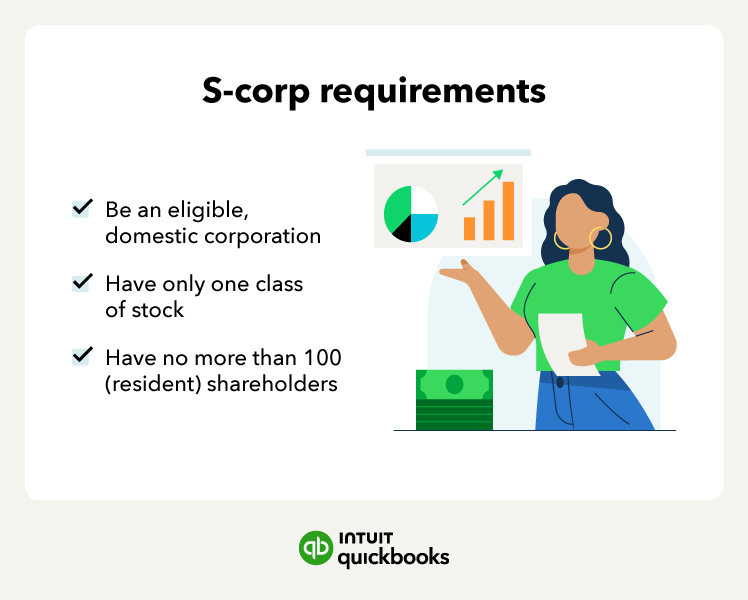

Now that you have a legal entity, complete with a registered name and EIN number, it’s time to review the S-corp election requirements and elect S-corp status. Below are the criteria that qualify your LLC or C-corp as an S-corp:

If your corporation can satisfy all of the requirements above, you can file S-corp Election Form 2253 to apply for S-corp status. In general, you have two and a half months from the beginning of the tax year to complete the application process and claim S-corp status.

No matter what stage your business is in, QuickBooks can help you manage your business finances.

Start hereAlong with the S-corp eligibility requirements shown above, you must also pay attention to the following factors to keep your S-corp status active:

As long as you can adhere to the regulations that come with being an S-corp, you can take full advantage of the taxation benefits that popularize this business type. Let’s explore the advantages of starting an S corporation below.

The tax advantages and liability protection offered by S-corp status make it an attractive option for small business owners and solopreneurs alike. Electing S-corp status has two major pros for shareholders:

Although an S-corp has unique taxation requirements, there are payroll services for S corporations available. If these tax write-off wins sound advantageous for your business, it’s time to consider if an S-corp is right for you.

Determining whether an S-corp is the right choice for your business requires careful consideration. Here are some key points to help guide your decision:

Regardless of whether an S-corp, is the right status for your business, consult with your financial advisor and tax professionals before electing a new business status.

As you consider learning how to start an S-corp, remember that your business can only qualify for advantages like the pass-through tax if you adhere to the requirements above. In order to do so, you may need the help of accounting software .

From registering your business to electing an LLC or C-corp status, staying organized every step ofthe way is vital to the success as an S-corp. To keep your status valid, maintain adherence to the S-corp guidelines.

According to the five-year rule, if an S corporation is terminated, the business may be subjected to specific tax consequences for five years. During this time frame, certain tax benefits that were previously available to the S corporation may not be accessible to the company or its shareholders.

Can you convert an LLC to an S-corp?Yes, it is possible to convert an LLC to an S corporation. This process involves filing Form 2553 with the Internal Revenue Service (IRS) to elect S corporation status for the LLC.

Can you create an S-corp as a one-person business?Yes, it is possible to establish an S-corp as a one-person business. While traditionally S corporations are formed with multiple shareholders, the IRS allows a single individual to set up an S corporation. As an individual, you can be the sole shareholder, director, and employee of the S-corp.

What is an S-corp 1099 form?An S-corp 1099 form typically refers to the 1099-MISC form , which S corporations use to report various payments made to individuals or unincorporated businesses exceeding $600 in a tax year.

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/

Recommended for you

Starting a business

How to register your business in 6 easy steps

What is a pass-through entity? How it works and types

10-step guide to starting a corporation as a small business owner

November 29, 2023

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.